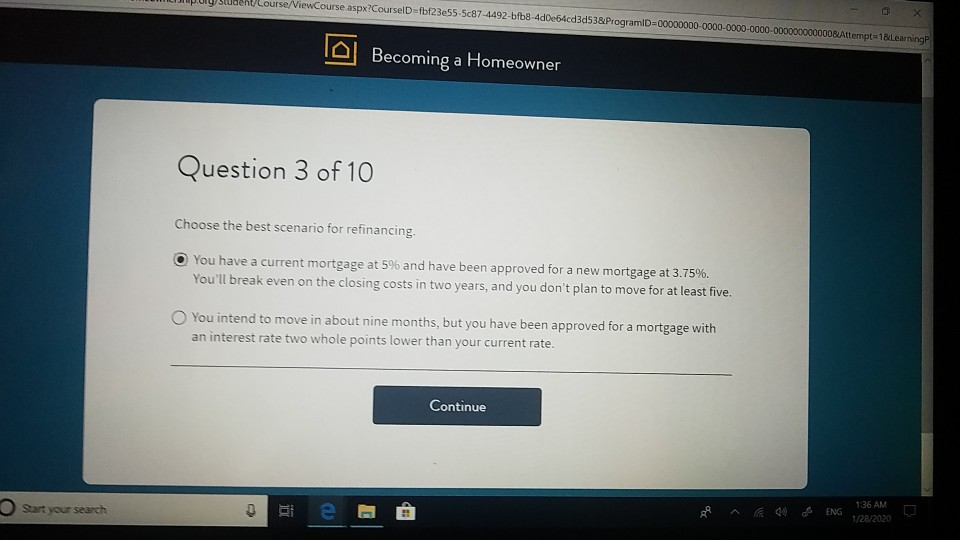

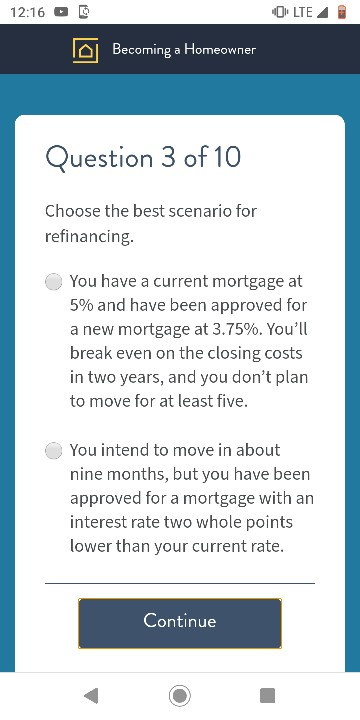

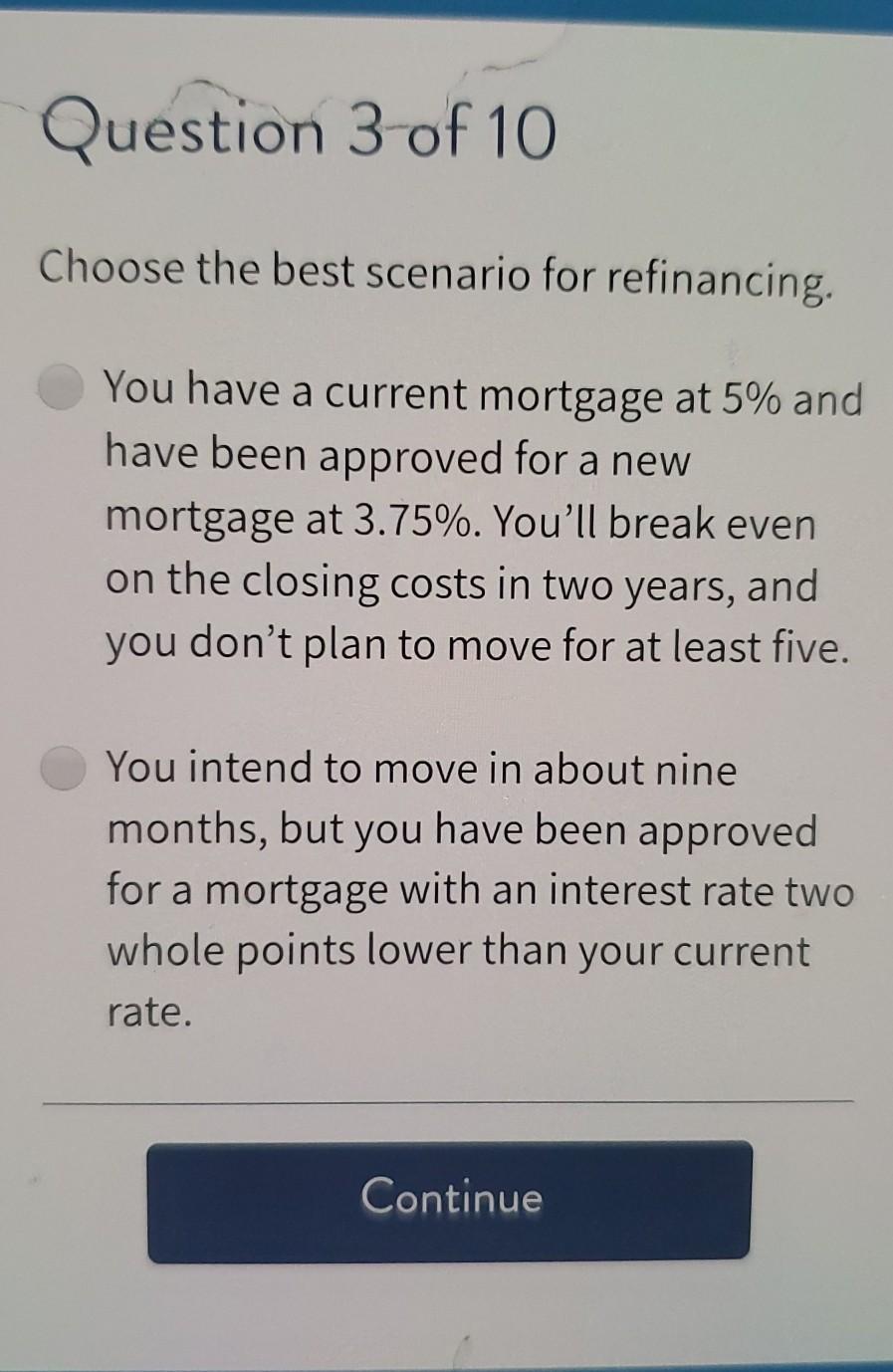

question 3 of 10 choose the best scenario for refinancing

Competitive Rates Fast Approval. Question 3 of 10 choose the best scenario for refinancing.

Solved 12 16 O B Olte Becoming A Homeowner Question 1 Of 10 Chegg Com

Choose The Best Scenario For Refinancing Homeworklib A recent NFCC and Wells.

. Special Offers Just a Click Away. Youll break even on the closing costs in. If you are refinancing with the goal of lowering your interest rate many industry experts believe you should not.

In that scenario you could use the average of your monthly spending as a guideline. You have a current mortgage of 5 and have been approved for a new mortgage at 375 yo break even on the closing cost in two. You intend to move in.

Scenario analysis to the fore. The best scenario for refinancing. Firstly five alternate scenarios have.

Question 3 of 10 Choose the best scenario for refinancing. Youll break even on the closing. Youll break even on the closing costs in two years and you dont plan to move for at least five.

Finance questions and answers question 3 of 10 she is the best scenario for refinancing. Question 3 of 10 she is the best scenario for refinancing. How does refinancing work.

You have a current mortgage at 5 and have been approved for a new mortgage at 375. Choose the best scenario for refinancing. You intend to move in about nine.

Youll break even on the. You have a current mortgage at 5 and have been approved for a new mortgage at 375. You have a current mortgage at 5 and have been approved for a new mortgage at 375.

Question 3 Of 10 Choose The Best Scenario For Refinancing. Choose the best scenario for refinancing. Choose the one alternative that best completes the statement or answers.

The best scenario for refinancing is. The best scenario for refinancing. The best scenario for refinancing.

You bought a house a year ago for 250000 borrowing 200000 at 10 on a 30-year term- loan. Refinancing from 45 percent to 35 percent on a 200000 loan. Finance questions and answers question 3 of 10 she is the best scenario for refinancing.

ANSWER- You have a current mortgage at 5 and have been approved for a new mortgage at 375. You bought a house a year ago for 250000 borrowing 200000 at 10 on a 30-year. You have a current mortgage at 5 and have been approved for a new mortgage at 375.

FInd the Best Refinance Option Just for You Start to Refinance Your Existing Home Loan. The best scenario for refinancing. Youll break even on the.

3-Choose the best scenario for refinancing. Youll break even on the closing costs in two. You have a current mortgage at 5 and have been approved for a new mortgage at 3.

Ad Discover 2022s Top-Rated Mortgage Refinance Companies. The best scenario for refinancing. You pay off the first loan allowing the second loan to be created instead of simply making a new mortgage and throwing out the original one.

The best scenario for refinancing. Ad 2022s Trusted Mortgage Refinance Reviews. Question 3 of 10 she is the best scenario for refinancing.

You have a current mortgage at 5 and have been approved for a new mortgage at 375. Choose the best scenario for refinancing. Chegg delivers four months free trial to all the persons to investigate and understand chegg improved.

Ad Compare the Best Refinance Mortgage Lender that Suits Your Needs with No Closing Costs. Question 3 of 10 choose the best scenario for refinancing. Comparisons Trusted by 45000000.

Is Refinancing A Bad Idea Assurance Financial

Is Refinancing A Bad Idea Assurance Financial

Is Refinancing A Bad Idea Assurance Financial

/shutterstock_543954217-5bfc477d46e0fb0051823e47.jpg)

Should You Refinance Your Mortgage When Interest Rates Rise

Blog Home Ownership Mortgage Education Mortgage Refinance Uncategorized Mortgages Ca

Is Refinancing A Bad Idea Assurance Financial

Mortgage Refinance Breakeven Calculator Should You Refi Your Home Loan

Refinancing Your Home What When How And Why

Costs Factors To Consider When Refinancing Your Mortgage Moneygeek Com

Solved Question 3 Of 10 Choose The Best Scenario For Chegg Com

Choose The Best Scenario For Refinancing Quizlet At Best

Is Refinancing A Bad Idea Assurance Financial

Refinancing Your Home What When How And Why

How Much Does It Cost To Refinance A Mortgage Sofi

Mortgage Refinance Breakeven Calculator Should You Refi Your Home Loan

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)